Vision-Focused Investing™

We work with you to establish your investment plan. What makes sense for you and your family?

We consider:

-

- Protection

- Security

- Growth

- What’s important about money to you?

Meeting Request

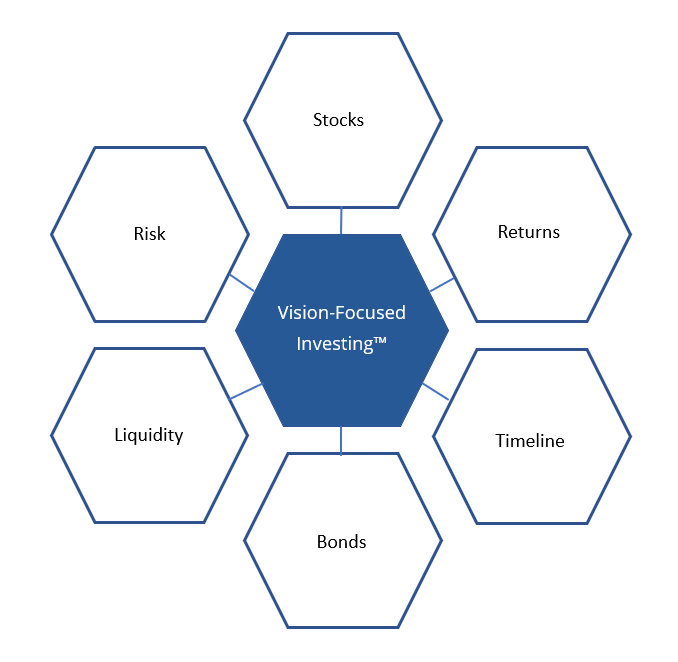

Vision-Focused Planning™ is our approach that serves as a starting point for where we want to go. It’s a well-defined process of discussing client goals, concerns, and values so that clients can reflect and consider different possibilities and priorities. This diagram reflects the many things that influence your future and your finances.

Vision-Focused Planning™ is a structured process that helps us get to the bottom of your hopes and dreams while taking into account the many factors that influence both the goals and the journey.

Vision-Focused Investing™ follows our Vision-Focused Planning™ to discuss investment strategies, risk/returns, savings, asset growth, retirement spending and withdrawal strategies, investment strategies, known upcoming cash needs, and cash reserves for unexpected needs and opportunities. There’s a big overlap with our Vision-Focused Planning™ because investment strategy is an important part of your overall financial plan, but Vision-Focused Investing™ is our process that specifically focuses on your investments.

The optimum advisor-client relationship comes from understanding how we can best serve our clients, and that only comes from a level of trust gained through us truly knowing our clients.

Vision-Focused Investing™

We offer objective financial advice in a purely fiduciary role. We receive no commissions or incentive payments to direct you one way or the other, and we are not controlled by, or affiliated with, any entity that pushes our decisions in any particular direction for their own benefit.

We are here to help, advise and guide.

We follow science backed investment principles that have been shown to work over the long term. These principles have proven to be so true that the economists who were the first to grasp these principles were awarded Nobel prizes for their breakthrough ideas.

We follow passive investing principles where we invest in global markets. The US stock market represents only 55 to 60% of the global stock market. Investing globally gives us greater diversification.

“Diversification is the only free lunch in finance.” – Dr. Harry Markowitz, Nobel Laureate in Economics

We base our investment guidance on principles that have shown to be true over time. Hope is not an effective strategy. We believe that investing with patience and discipline leads to success.